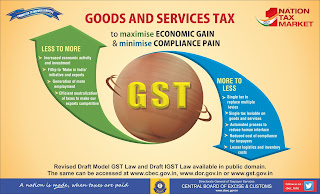

GST - Things you should know

I ndia’s tax regime depends heavily on indirect taxes. Revenue from indirect taxes is the major source of tax revenue for the government of India. The dependence on indirect tax for India is due to the fact that its majority of population is poor and so there are inherent limitations in widening the base of direct taxes. The government of India is , therefore, inclined to widen the base of indirect taxes in the form of GST. G ST stands for ‘ goods and services tax ‘ and is proposed to be comprehensive indirect tax on manufacture, sale and consumption of goods as well as services at the national level. The proposed GST contains all the indirect taxes levied at central and state level. The central taxes like central excise duty, central sales tax, custom duties will all be subsumed in GST. The state level taxes like vat tax, entertainment tax, taxes on lottery, entry tax, luxury tax, advertisement tax and taxes on interstate transportation of goods all will be subsumed with GST...