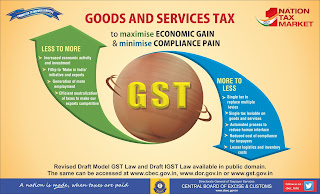

GST - Things you should know

India’s tax regime depends heavily on indirect taxes. Revenue from indirect taxes is the major source of tax revenue for the government of India. The dependence on indirect tax for India is due to the fact that its majority of population is poor and so there are inherent limitations in widening the base of direct taxes. The government of India is , therefore, inclined to widen the base of indirect taxes in the form of GST.

GST stands for ‘ goods and services tax ‘ and is proposed to be comprehensive indirect tax on manufacture, sale and consumption of goods as well as services at the national level. The proposed GST contains all the indirect taxes levied at central and state level. The central taxes like central excise duty, central sales tax, custom duties will all be subsumed in GST. The state level taxes like vat tax, entertainment tax, taxes on lottery, entry tax, luxury tax, advertisement tax and taxes on interstate transportation of goods all will be subsumed with GST. But still there are taxes like basic custom duty, taxes on alcohol for human consumption, taxes on petrol/ diesel/ aviation fuel/ natural gas, stamp duty and property tax, toll tax and electricity duty , which are not subsumed with GST.

GST bill was introduced in parliament on 19th of december, 2014 as the constitution ( 122nd amendment ) bill. The bill was passed in the lok sabha on 6th of may, 2015 , but remained pending in the rajya sabha due to lack of majority of the ruling government. On june 14, 2016 the finance ministry released draft model law on GST in public domain for views and suggestions. Then the GST bill was passed in the rajya sabha on 3rd of august, 2016 with certain modifications. The amendments made by the rajya sabha were subsequently passed in the lok sabha unanimously. Thereafter, the bill was adopted by majority of the state legislatures where in at least 50% of the state approval is required. Finally, the hon’ble President of India gave his approval on 8th of september, 2016 and the constitution ( 122nd amendment ) bill became an act and the same has been notified as the 101st amendment act 2016. In this way after passage in parliament and President approval, the below noted four GST related bills became Act.

- Central GST bill

- Integrated GST bill

- Union territory GST bill

- GST ( compensation to states ) bill

The long awaited bill has been successfully rolled out on 1st of july, 2017.

For businesses, their first step towards new taxation system is to get there firm registered under GST transition process. All existing business firms registered with any of the current laws ( vat/ excise/ service tax ) will also need to register under GST necessarily. GST registration threshold is Rs 10 lakh for special category states ( Arunachal Pradesh, Assam, Jammu and Kashmir, Manipur , Meghalya , Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh and Uttarakhand) and Rs 20 lakh for rest of India. Small business firms with turnover below Rs 50 lakh have an option of adopting a composition scheme and pay flat tax of 1 to 4% on turnover.

A normal taxpayer can go for GST registration by accessing to the site https://www.gst.gov.in/url. Registration process consists of the following steps:

- Fill part A of form GST REG - 01. In this form mainly PAN number, mobile number, email id etc are required. Submit the form.

- PAN number will be verified on GST portal while mobile number and email id will be verified on OTP.

- You will receive an application reference number on your mobile and email.

- Fill form B of form GST REG - 01 wherein mention the application reference number you received. Attach required documents like photograph, constitution proof, bank account proof, proof of rented or owned premises. Submit the form.

- In case any additional information is required, GST REG - 03 will be issued to you and you are to respond in GST REG - 04 within seven working days.

- With all the required informations received vide forms GST REG - 01 and GST REG - 04 , a certificate of registration in form GST REG - 06 will be issued within 3 days from the date of GST REG - 01 or GST REG - 03.

- If the details submitted are not satisfactory, the registration application will be rejected using the form GST REG - 05.

Registration of GST is mandatory for the following categories irrespective of their turnover .

- Taxable person carrying on interstate supply.

- Casual and non-resident taxable persons.

- Businesses liable to pay tax under reverse charge.

- Agents supplying on behalf of a taxable person.

- Input service distributor.

- Sellers on e-commerce platforms.

- All e-commerce operators.

- Persons responsible for deducting Tds.

- Persons supplying on line information and database access or retrieved services from outside India to an unregistered person in India.

A notification for constitution of GST council was issued by the President of India on 10th of september, 2016. The GST council formed is a joint forum of ministers both from the centre and the state. The GST council formed is authorised to make recommendations to the centre and the state on all important issues related to GST for example goods and services exempted from GST, GST rates, special provisions for certain states and transition provisions etc.

GST is likely to improve tax collections and boost India’s economic development by breaking the barriers between states and integrating India through a uniform tax rate. It will have the following benefits;

- GST will replace all the central and state indirect taxes and hence compliance cost will fall.

- Input tax credit will encourage suppliers to pay taxes and thus broadening the base of taxpayers.

- Number of tax departments will reduce leading to less corruption.

- Tax cascading will be eliminated and hence GDP will rise.

- Lower logistic and tax costs will make manufactured goods cheaper.

- GST will bring more transparency and better compliance.

- It is very beneficial for export oriented businesses as it is not applied for goods / services which are exported out of India.

- The final consumer will bear only the GST charged by the latest dealer in the supply chain.

Challenges are likely to be faced both by the centre and the state governments. Some states like Jharkhand are mostly dependent on their products rather than services. These states will have to share their revenue with the central government and it is going to be a huge loss for them as they do not have adequate services for compensation for the loss.Also, GST is going to make the central government more powerful because the centre has to specify the rate of GST that has to be shared with the states. There are the chances for some states to go to loss. The centre may hike the tax rates for compensation of some states resulting in some protests from other corners.

About 140 countries are already following GST tax system. France was the first country to implement it in 1954. GST in India will be the biggest tax reform after independence. This tax reform is expected to boost the rate of economic growth, broaden the revenue base and cut compliance cost of firms. This reform can be a continuing process until it is fully evolved.

Comments

Post a Comment